indonesian bukalapak 1.1b ipo: Bukalapak is an Indonesian e-commerce company. The company’s Initial Public Offering (IPO) is a process by which it sells shares of its stock to the public for the first time, in order to raise capital and increase liquidity for its shareholders.

In 2021, indonesian bukalapak 1.1b ipo announced plans to go public with an initial valuation of 1.1 billion dollars. The specifics of the IPO, such as the date, price range, and number of shares offered, have not announce yet. It is not uncommon for companies to go through several changes to their IPO plans before the process is complete.

IPOs can be a complex process, and investors should carefully consider the risks and benefits before investing. It is important to do your own research and seek the advice of a financial professional if you are considering investing in an IPO.

Table of Contents

Indonesian bukalapak 1.1b ipo

indonesian bukalapak 1.1b ipo e-commerce company that provides online marketplace and delivery services. The company announced plans to go public in 2021 with an initial valuation of $1.1 billion.

An IPO is a complex process and can take several months or longer to complete. It involves the sale of shares of a company’s stock to the public for the first time, allowing the company to raise capital and increase its liquidity.

It is important to note that investing in an IPO can be risky and that there is no guarantee of profit. Before investing in an IPO

bukalapak ipo price

Bukalapak’s Initial Public Offering (IPO) has not officially announce. The details of indonesian bukalapak 1.1b ipo, including the price range and the number of shares offered, are subject to change and may not be known until closer to the offering date.

It is important to note that investing in an Initial Public Offering (IPO) can be risky and that there is no guarantee of profit. Before investing in an IPO, it is recommended to carefully consider the risks involved and to seek the advice of a financial professional.

Bukalapak ipo Date

The date for Bukalapak’s Initial Public Offering (IPO) has not officially announce. IPO dates are subject to change and can impact by a variety of factors, including market conditions, regulatory approval, and other considerations.

If you have interest in investing in Bukalapak’s IPO, it is important to monitor news and updates from the company and to seek the advice of a financial professional. Additionally, it recommend to thoroughly research the company, its financial performance, and its industry before making any investment decisions.

Goto ipo

Goto is a Japanese online marketplace and delivery service. An IPO is the process by which a privately-held company goes public by selling shares of its stock to the public for the first time. An IPO allows a company to raise capital, increase its liquidity, and provide an exit for its early investors and employees.

If Goto does decide to go public in the future, the specifics of its IPO, such as the date, price range, and number of shares offer, will be subject to change and may not be known until closer to the offering date.

Gojek ipo date

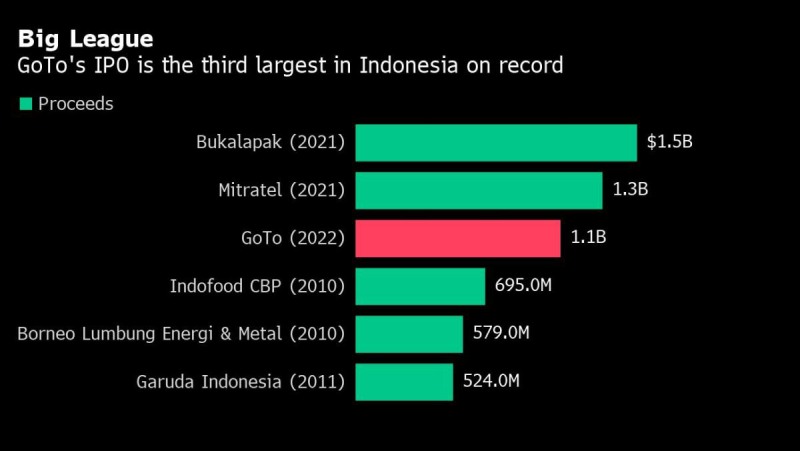

Gojek is found in 2010 by Kevin Aluwi, Michaelangelo Moran, and Nadiem Makarim. The Indonesian multi-service company merged with e-commerce company Tokopedia to form GoTo, a holding company that accounts for 2% of Indonesia’s GDP. GoTo plans to go public in Indonesia in April 2022, hoping to raise up to $28 billion. While the company has previously discussed the possibility of dual listings in Jakarta and New York, it has not finalized plans for a US IPO. These comments should not construe as an indication that the Company is formally seeking or refraining from going public.

Gojek, Indonesia’s first unicorn, started as a ridesharing app but has since expanded to offer 20 unique services that include food delivery, payment processing, video streaming, package delivery,… insurance, telehealth, drug delivery and web design. The company operates in Indonesia, Vietnam, Thailand, Singapore, Philippines and India. Gojek has acquired 13 companies and received over $6 billion in venture capital from investors including Astra International, Blibli, Google, Facebook, PayPal, Mitsubishi, Sequoia, Northstar Group and Visa. The company has a post-money valuation of $10 billion.